This includes your income assets and liabilities. The First Foundation.

4 Steps To Build An Emergency Fund Emergency Fund Build Emergency Fund Financial Goals

Next decide whether to structure your foundation as a charitable trust or a nonprofit corporation.

. The Five Foundations of the curriculum are the following. You should do this as quickly as possible. 36 offers from 738.

The Foundations in Personal Finance curriculum is modeled on Ramseys Seven Baby Steps. Interest paid on interest previously earned. Government can use taxes as a tool to direct business investment to research and development projects to the inner cities and to projects that create jobs.

We particularly focus on low-income communities. As your local bank were your. Personal banking is the act of providing bank products and services to individuals and families.

When youre in high school. Build wealth and give. Compares after-tax income to the money people spend on a variety of items.

Up to 24 cash back Identify changes in personal spending behavior that contribute to wealth building. If you start investing now. Ad Connect with a Lender who can assist with Debt Support Urgent Expenses and More.

This is due to. First it can free up more money in your budget so youre less inclined to rely on credit cards or loans to cover spending gaps. This principle suggests that a certain amount of money today has different buying power than the same amount of money in the future.

Which of the following is not one of the three basic reasons for saving money. Top Rated Lenders in your Area are here to Help. A charitable organization that while serving a good cause does not qualify as a public charity by government standards.

The first foundation is ___ in an emergency fund. Second if you have debt adding extra money. Select a call by topic to hear real-life financial dilemmas and apply some of the personal finance principles you are learning to these situations.

Up to 24 cash back 4 Foundations in Personal Finance dave ramsey a personal money management expert is an extremely popular national radio personality and author of the New. It might sound like. Decide between trust and nonprofit.

The First Financial Foundation supports programs and organizations that enhance and develop the communities in which we do business. A private foundation is a. Getting out of Debt Report.

The First Financial Foundation was created in 2017 to support programs and organizations that enhance and develop the communities in which we do business. A charitable trust can be easier to. Instead of borrowing money for large purchases you should set money aside in a _________ over time and.

Covered in Foundations in Personal Finance our 12-chapter industry-leading personal finance curriculathese principles will help you change your students lives forever. These products typically include checking and savings accounts certificates of deposit debit. Dont see your collegeuniversity.

Explain the difference between a cash flow statement and a budget. When a person intentionally invests. Foundations in Personal Finance Workbook High School Edition For Homeschool by Dave Ramsey Financial Peace Univeristy Paperback 45 out of 5 stars.

When developing a personal financial plan one of the first things you should do is assess your current financial situation.

Budget 101 Your Complete Guide To Building Your Budget Level Up Personal Finance Budgeting Budgeting 101 Personal Finance

How To Do A Financial Inventory With Your Money Personal Finance Budget Personal Finance Books Ecommerce Startup

How To Start Your First Basic Personal Financial Plan Personal Financial Planning Financial Planning Budgeting Finances

Are You Looking To Increase Your Financial Freedom Learn From Our Personal Finance Experts On How Personal Finance Personal Finance Lessons Financial Freedom

5 Tasks For March Money Management Financial Checklist Financial Planning Printables Money Management

Your Personal Finance Journey Personal Finance Finance Finance Lessons

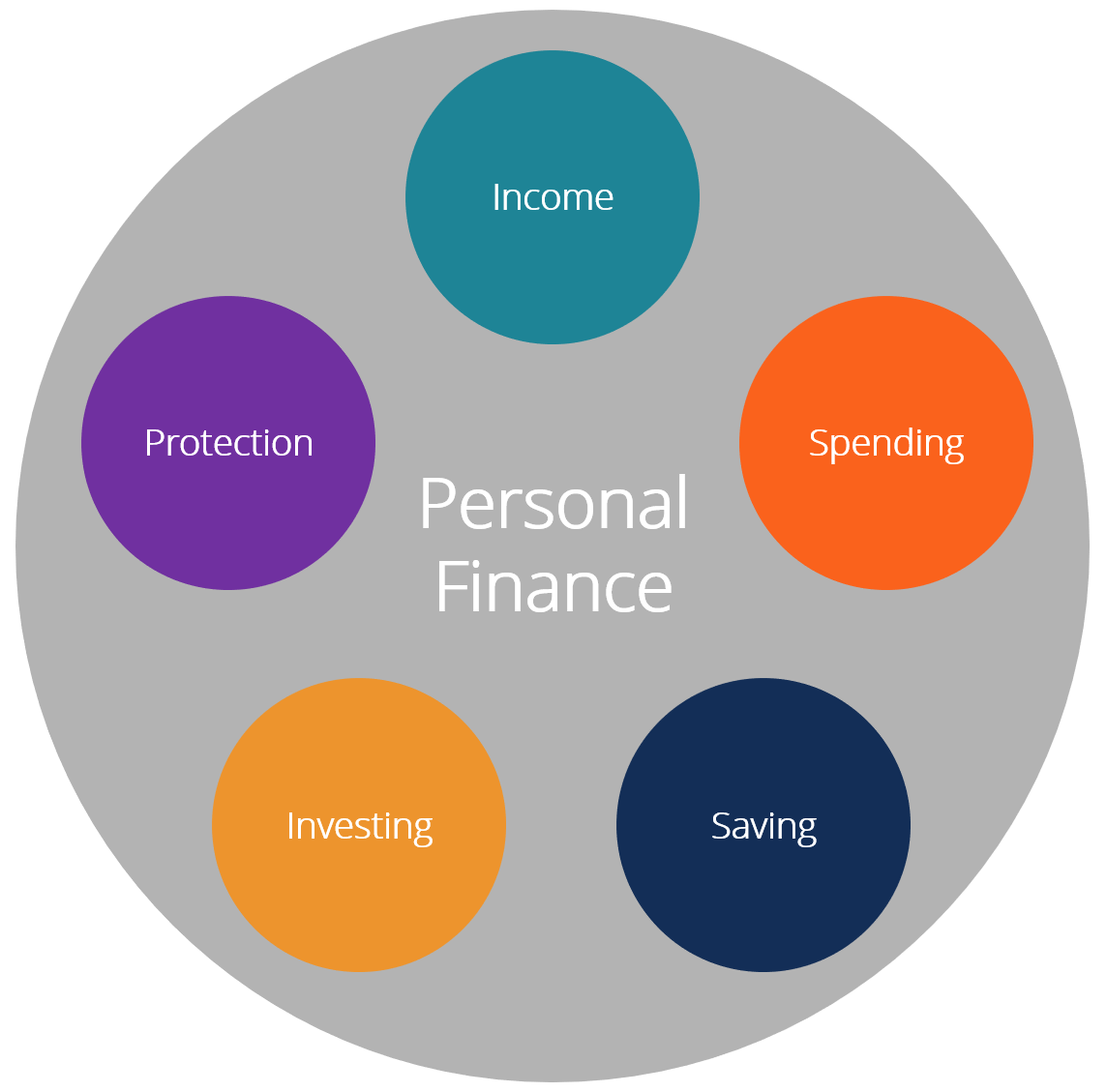

Personal Finance Definition Overview Guide To Financial Planning

0 comments

Post a Comment